There’s a saying among the rich that making the first million is the hardest. It gets easier after that.

The actual quote is attributed to British retail entrepreneur Theo Paphitis: “Making the first million is hard; making the next 100 million is easy.”

That’s because the power of compounding starts to kick in once savings hit the million mark. Getting to R1 million is the challenge, given the difficulties of making ends meet on an average South African salary.

South Africans are notoriously poor (or incapable) of saving, living from pay cheque to pay cheque.

National Treasury estimates that just 6% of the population will retire comfortably, so it’s clear that the remaining 94% will have to lower their living standards in their retirement years or continue working.

We decided to put this to the test and see whether the average salary earner could become a millionaire and over what time period.

The theory

It’s by no means impossible to do.

Author David Parker, in his book Income and Wealth, explains how it’s possible to become a millionaire on a McDonald’s worker’s salary. It’s a radical idea that requires saving as much as 50% of what you earn in the early years – even if it means staying with your parents to save costs and then building up sufficient savings as a down payment for a property.

Read: Is it possible to become financially independent on a McDonalds’ worker wage?

It takes about 10 years to get there, but the next 10 years are when your property portfolio, using bank loans and savings, starts to build. Parker did it on a teacher’s salary and became a multi-millionaire in the process.

The how

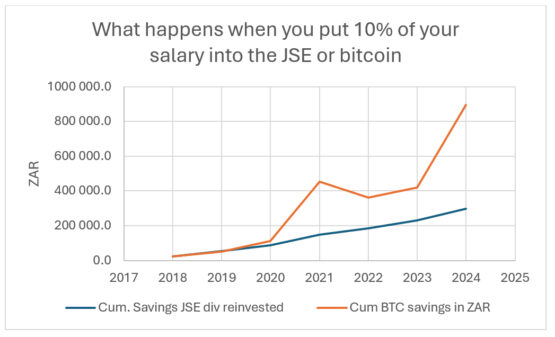

To bring the exercise back to South Africa, we made the assumption that 10% of the average salary is saved each month and invested once a year in either the JSE or bitcoin. No allowance is made for tax, which will vary widely depending on circumstances and investment choices (such as tax-free savings accounts), so bear that in mind.

Stats SA puts the average SA salary at just below R27 000 per month in 2024, a figure that has grown at about 6% a year since 2018. So we will assume the average salary will continue to grow by 6% a year into the future.

If you religiously saved 10% of your salary beginning in 2018 and placed 10% into a savings account, you’ll hit R1 million in savings by 2031 (again, no allowance is made for tax on interest or income).

It’s slow freight, but you get there in 13 years.

Now let’s put it in the JSE and reinvest dividends, which we assume will average 3.5% a year. Assuming the JSE continues to grow at its historical average of 6.5% a year and reinvest dividends, we’ll also hit R1 million by 2031.

That may be unfair to the JSE, which is already up nearly 10% so far this year, in large part due to the new government of national unity.

If we extrapolate a 10% annual average growth in the JSE All Share Index into the future, we hit the R1 million mark a year earlier – in 2030.

Fast-tracking with crypto

Now let’s get reckless and put all our savings into bitcoin. The results are shown in the graph below.

At current growth rates, we’ll hit the R1 million mark by 2025, or seven years.

Obviously, this is not advisable for most, given bitcoin’s volatility, but it’s an interesting exercise nonetheless.

We asked actuary Harry Scherzer, CEO of Future Forex, to throw another option into the mix – crypto arbitrage.

This is lower risk than bitcoin and involves buying and selling cryptos on overseas exchanges and selling them locally. The market risks are hedged out, so profits are locked in at the start of the trade (which is usually closed out on the same day).

Read: What happens when you pump 10% of your salary into bitcoin

The remaining risks are third-party risks, meaning the possibility of banks and other intermediaries involved in the trade going bust while the trade is underway.

You need a minimum of R100 000 to participate in crypto arbitrage, which means you will only start trading in 2022.

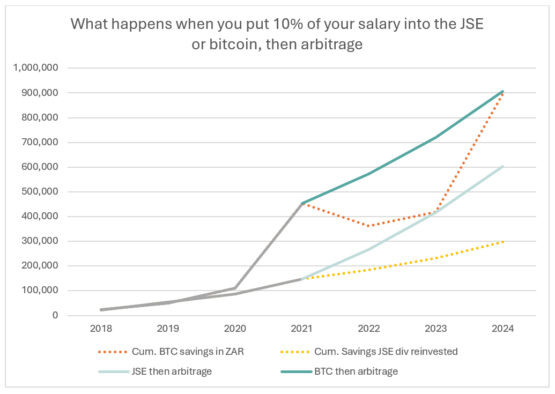

Here’s what the results look like.

Source: Stats SA, Moneyweb, Future Forex. *Assumes that you only start investing in arbitrage in 2022. Also assumes you utilise your full foreign allowances of R11 million in the year that you invest in arbitrage, based on average crypto arbitrage returns over that year. Note this ignores tax.

The chart above assumes that you accumulate savings in either the JSE or bitcoin until reaching R100 000 and then switch to arbitrage trading.

Arbitrage achieves roughly the same result as a direct investment in bitcoin, getting you to the R1 million mark by 2025, but without its volatility.

There are many other options that could be thrown into the mix, but the point of the exercise is to show that reaching millionaire status is within reach for the average salary earner.

Read: Become a millionaire. It’s easier than you think

The main point is to start saving and aim for 10% a month as a good start. If you adopt Parker’s methodology and manage to save 50%, you’ll get there much quicker.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

COMMENTS 14

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.

Yes, it is. Just go into politics.

118

5

… and do not forget the preaching profession……

95

14

. . . Or join one of the various criminal enterprises, e.g. construction mafias, extortion syndicates, kidnapping syndicates, truck and car hijacking outfits, etc. Big time crime pays big time in S.A., and there’s no tax on “profits”.

4

Apart from the obvious, this article is meaningless.

52

22

Apart from the obvious, this comment is meaningless.

37

27

What about inflation/TVM?

12

3

Before you buy that expensive whisky to celebrate your newly founded millionaire status, you must survive the ambush of the process of taxation plus inflation that the democratically elected government set specifically for endeavoring individuals like yourself.

Net asset worth – Capital Gains Tax – estate duties = Net Worth After Tax. It is irrelevant whether you have realized the capital gain or whether the estate duties have become due, that money may still be accounted as your assets, but, by law, it belongs to the government already.

As a meaningful comparison, calculate the after-tax value of your assets in purchasing power and compare that value to the initial investment 40 or 60 years ago and the true picture emerges.

Expropriation without compensation was legalized long ago. They just camouflaged this Master Confiscator with the combination of inflation and taxation.

Now go and buy the whisky.

63

4

The premise of the article is based on a book written in the US for Americans. The federal tax rate for single filing is 12% for taxable earnings up to ZAR846k. That is before deductions and tax credits which are extensive. Primary and secondary education is free, crime is basically non existent and goods are very competitively priced (e.g. fuel and power). Some states do not charge sales tax either. Inflation is currently at 2.53% in the US as well. If one were to invest in property, capital gains tax is deferred indefinitely as long as another house is purchased within a defined period. No wonder an individual would be able to actually become a millionaire.

In South Africa, goods are USD equivalent priced but we earn ZAR. Fuel and power costs are massively higher. Total taxes are not comparable (Individual taxation, VAT, import duties, fuel taxes, capital gains etc). A decent education for your kids is an out of pocket expense. Inflation is way higher. Most people barely cover monthly operational expenses as a result.

The article is cheeky. I enjoyed the comments 🙂

14

2

a million ZAR means nothing at all – in USD terms it starts to have a meaning

50

1

Worthless currency and npw they want to nationalize SARB so they can print more money and make it even more worthless

13

2

Buy Gold & Silver !!! I have been saying this for 7 years. R U watching??

4

10% savings account ?? Minus fees. Also not buying any large items like a car or a house. Who needs them. Living with your parents longer? Try sneaking your girlfriend into your room, without the parents noticing. Usually paying your home bond quicker, by adding extra cash every month is the way to save on a large portion of interest. R2 million house will cost you R5,285,212 over 20 years so while you are saving 1 million at a lesser rate of interest you are paying R 3,285,212 in interest. The bank you are saving at WINS. So it’s nice to say how to “figuratively” save R 1 million HOWEVER the terms of life consistently creep into your finances. So buy and older car and a property and pay it off in 7 years. That’s how you can save R1 million. Dr. Debt Financial Finesse

27

It is official govt policy to tax you into poverty in the name of equality. They have made it nearly impossible to become rich unless you have powerful connections inside govt.

Good luck living in La La land.

19

1

The article appears to have thrown together inputs from various sources or articles but therein starts to lose credibility. There are references to where we are in 2024, as well as 2018 as a starting point. It then goes on to say “which means you will only start trading in 2022”. Since that is two years in the past, reference should have been “you would have only started trading in 2022”, but more importantly should have explained what would have happened if he had invested as suggested and what would the bitcoin investment as an example returned.

Is the projection to 2025 still valid as this is only a few weeks away, and since we experienced unimaginable changes since 2018, is the 2030 and 2031 projection still valid?

In principle it gives the reader something to think about, but since much of what is written is historical it could have also highlighted that no investment is a guaranteed get (very) rich easy scheme.

2

Load All 14 Comments

End of comments.