If you look around the world today, most markets are at all-time highs or very close to it.

The JSE is sitting close to all-time highs, just slightly off from where it was about a week ago. The US Federal Reserve is expected to follow the European Central Bank and Bank of England in easing rates, which could push markets higher. However, concerns about the US economy’s trajectory – whether it faces a soft landing or a hard landing – remain at the forefront of investors’ minds.

JSE All Share Index

Similarly, US markets are also at their peaks.

Rate cuts are coming

The good news? The US Federal Reserve has indicated that it will likely cut rates at its next meeting on 18 September 2024. US inflation has finally dropped below 3%, and both the European Central Bank and the Bank of England have already started their rate-cutting cycles.

A rate cut lowers interest rates, making money cheaper, which often pushes markets higher. It also means lower yield from money markets, and some of the $5 trillion odd sitting in these instruments may find its way to capital markets.

A looming question: What’s next for the US economy?

You might have noticed the market jitters a few weeks back when US markets dropped off by about 8% in a couple of days before rebounding just as quickly. This move was a result of the monthly US jobs report showing only 114 000 new jobs were created, compared to an average of 250 000 over the past year.

The fear is that high rates have been in place for too long, potentially slowing the US economy and even risking a recession. The lower jobs number was seen to confirm this idea.

Soft landing or hard landing?

The debate is now about whether the US economy will experience a hard landing (recession) or a soft landing (no recession). Depending on this, the Fed’s behaviour will vary.

- A hard landing will likely mean sharp rate cuts in response a recession, and consequently declining equity markets. Bonds would perform well in this scenario.

- A soft landing would involve smaller rate cuts (50bps-100 bps), with the economy continuing to grow, leading to higher equity markets driven by continued growth in company revenues.

Historically, we’ve only seen this kind of soft landing once, in the mid-1990s. After a shorter rate hike cycle, US inflation cooled while the US economy remained strong. The result was a continued bull market up until 2000 and the dot-com crash.

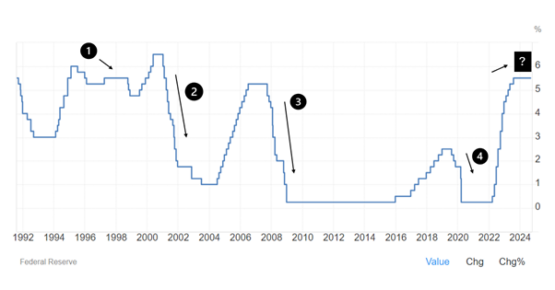

The chart below illustrates – see where I marked period 1. Rates only declined marginally.

US Fed Funds Rate

But history also shows us three major crashes – during the dot-com bubble, the global financial crisis, and the Covid crash – where rate cuts were drastic in response to economic crises. See periods 2, 3 and 4.

What’s next?

So, what kind of landing are we heading for now? Will we experience another crash like in the past three periods of steep rate drops? Or will the Fed manage to pull off a soft landing, like in the 1990s, allowing markets to continue their climb?

And what does this mean for your portfolio?

So, what should you be doing in your portfolio to prepare for this? Nothing. Literally. If you have a well-thought-out financial plan and a sound asset allocation strategy, your portfolio should be well-insulated against any short-term shocks. At the same time, it will be positioned to capture any potential upside.

We are long-term investors, not short-term traders, and should avoid getting carried away by the noise.

Stick to your plan, and trust the process.

COMMENTS 0

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.