In this second article on tax-smart with retirement annuities (RA), we look at what happens when your annual RA contributions exceed the tax-deductible limit and the tax benefits that you will receive.

RA contributions that exceed the tax-deductible limit are sometimes referred to as “disallowed contributions”. The word “disallowed” makes it sound like the investor/taxpayer has done something wrong or does not benefit from these contributions. In fact, the opposite is true. Officially, the South African Revenue Service refers to excess contributions.

Making excess contributions can:

- Increase the value of the portion of the retirement lump sum taken at/after retirement that attracts 0% tax;

- Reduce taxable pension, living annuity, or life annuity income as an exemption until the exemption amount is exhausted (Section 10C of the Income Tax Act);

- Reduce other taxable income (Section 11F of the Income Tax Act); and

- Reduce the taxable portion of any lump sum that beneficiaries choose to take after your death (however, it might attract estate duty if it is higher than the abatement limit).

Note that excess contributions can be made in any tax year before and even after you have retired from another fund, but the sequence of tax relief will always be applied in the order mentioned above without taxpayer preference.

This article will focus on the first three benefits mentioned above. The fourth benefit, excess contributions after your death, will be covered in a future article to show how excess contributions to a RA can be used as an estate planning tool.

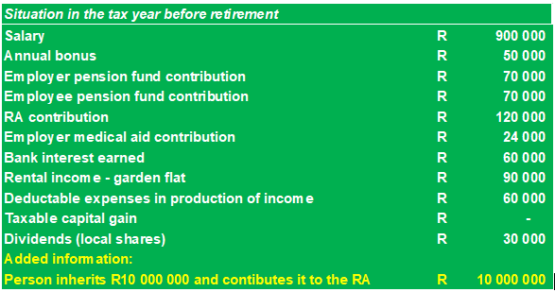

Let’s follow up on the example in Tax-smart with retirement annuities: Deduction calculation:

In their last year of employment, the client inherits R10 million and decides to invest it all in a RA. The garden flat income increased to R90 000 for the year. There are no capital gains for the year.

We apply the information to a personal tax template:

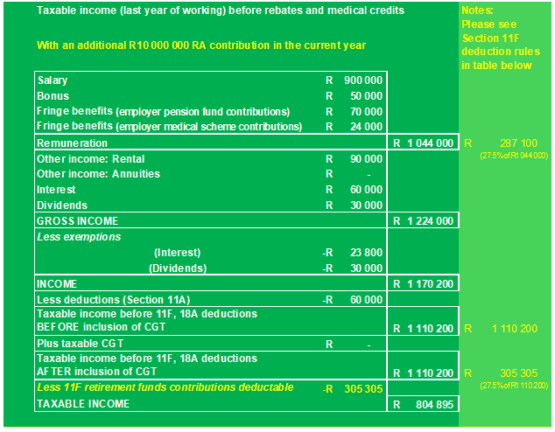

The calculation for the 11F deduction for the last year of working is shown below:

The client decides to retire on 1 March the following year. We assume that R5 million accumulated in all the retirement funds that the client contributed to, except for the R10 million lump sum invested in the RA. This means that there will be a total of R15 million in retirement funds, of which R5 million can be taken in cash (a maximum of one-third is allowed to be taken in cash from pension and RA funds).

The client, however, decides to only take R2 million in cash to buy a share in a beach house.

In their first year of retirement, the client requires a gross income of R60 000 per month from the living annuity. The garden flat is now rented out for R100 000 per year, and there are no capital gains. Allowable deductions in the production of income also decreased to R10 000 for the year.

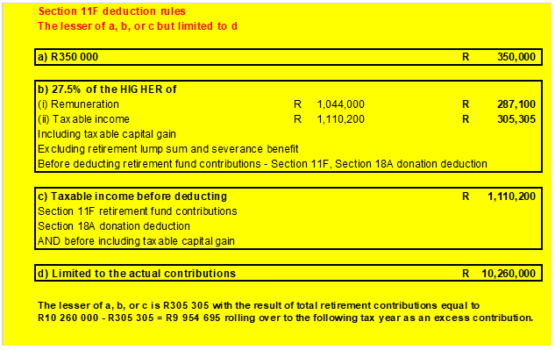

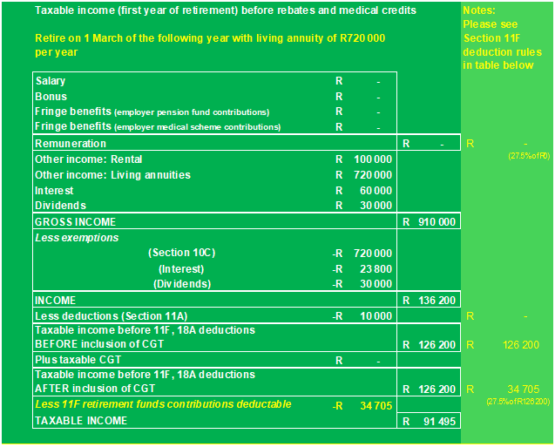

Applied to a personal tax template, the first year of retirement looks like this:

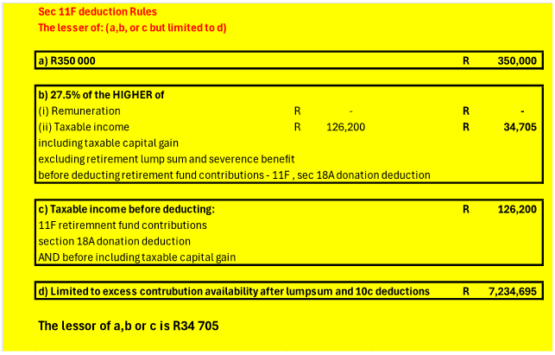

The calculation of the 11F deduction for the first year of retirement is shown below:

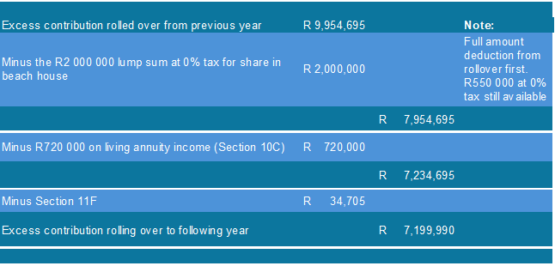

The excess contribution that was made in the previous tax year is now applied in a specific sequence:

- Firstly, as a deduction against any lump sum, in this case, R2 million.

- Secondly, it will be used as an exemption for pension and qualifying annuity income, in this case, the living annuity income of R720 000.

- Lastly, it can be applied as an 11F deduction if the taxpayer earns other income, as shown in the calculation above.

Let us look at the excess contribution calculation in practice:

After the exemptions and deductions above, there will be close to R7.2 million excess contributions rolling over to the following tax year. Considering that it will mainly be used for the exemption of the living annuity income in future, the taxpayer can expect several years of tax-exempt annuity income, obviously depending on the annual annuity income increase percentages.

The other aspects of excess contributions that you should take note of are:

Income from annuities in the same year as excess contributions

The Section 10C exemption for pension, life annuity, or living annuity income only becomes applicable for the first time in the tax year after the excess RA contribution was made. Excess contributions can be made in a RA at any time before or after retirement.

Estate duty

With a living annuity, the balance of the excess contributions is included for estate duty but not if the beneficiaries choose to continue drawing monthly income from the living annuity transferred to them. If a beneficiary chooses to take a lump sum instead, any remaining excess contributions will be included for estate duty purposes. It is a good idea to have a conversation with your beneficiaries concerning the options prior to your death.

Transferability at death

Excess contributions cannot be transferred to any beneficiary but can, together with the R550 000 that was not utilised (as in the example), increase the tax-free portion of the inherited living annuity if a lump sum payout is chosen.

In closing, the example presented in this article is not meant to show how retirement must be planned:

- Other information applicable to an individual must be considered.

- There are a few ways to design a more balanced retirement structure that considers compulsory (retirement) and voluntary (discretionary) funds.

However, what this article does point out is how excess contributions can be an important tool in retirement planning because of their tax efficiency.

In the previous article, Tax-smart with retirement annuities: Deduction calculation, we looked at the principle of the tax deductibility of your RA contributions from your taxable income and how this can have significant tax-saving and retirement-funding benefits.

COMMENTS 0

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.