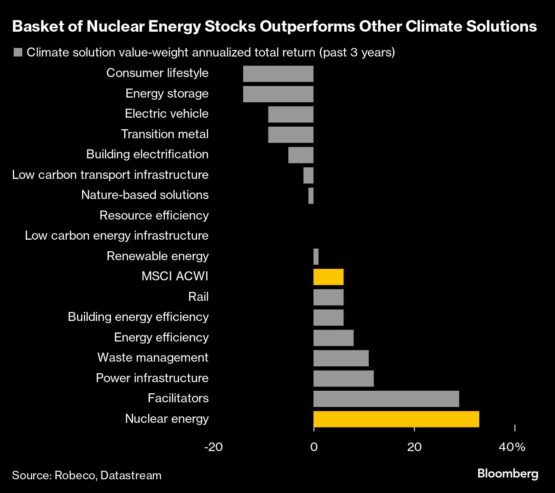

Fund managers are betting that nuclear energy, an area traditionally off-bounds for investors with environmental mandates, is set to make a comeback.

Robeco Institutional Asset Management, J O Hambro Capital Management and Janus Henderson Investors are among firms that see a role for stocks exposed to nuclear energy in their portfolios, according to representatives interviewed by Bloomberg.

“In the past, we were more on the very cautious side and exclusionary approach,” said Chris Berkouwer, lead manager for Robeco’s Net Zero 2050 Climate Equities fund. But it’s now clear that nuclear is “an indispensable part” of eliminating greenhouse-gas emissions, he said.

The addition of nuclear to portfolios marketed as environmentally friendly is sure to fuel debate. Sceptics point to an array of concerns spanning nuclear waste to the supply of uranium, as well as geopolitical shocks. That’s as Vladimir Putin’s war in Ukraine spurs new levels of global anxiety after the Zaporizhzhia nuclear power plant came under Russian control.

Proponents counter that running a nuclear power reactor is emissions free. And nuclear plants can generate enormous levels of electricity using just small quantities of fuel, making them more efficient than other energy sources. It’s one of the reasons why nuclear is the largest source of clean power in the US, France and South Korea.

In the European Union, heavy lobbying from France helped get nuclear into the bloc’s so-called green taxonomy back in 2022.

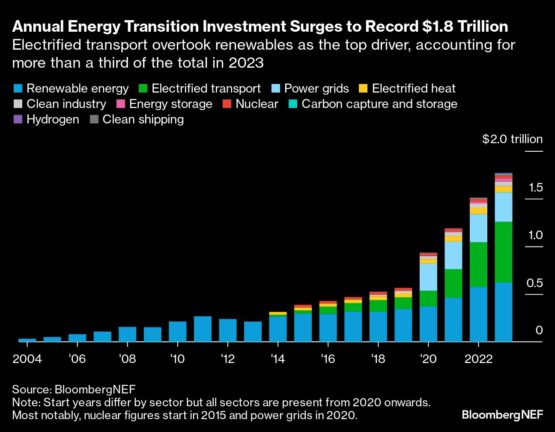

At BlackRock Investment Institute, a unit of BlackRock Inc., nuclear is regarded as part of the energy mix needed to power the vast data centres being built by the technology industry.

“As AI adoption grows, that power demand is likely to at least double — and possibly quadruple — by the end of this decade,” Alastair Bishop, global head of sustainable core investing and a portfolio manager at BlackRock Investment Institute, said during a media briefing in July. “That’s going to have profound implications for the power market.”

Robert Lancastle, a portfolio manager at J O Hambro, says that without nuclear power, it’s unlikely the world will have enough energy to support the continued growth of artificial intelligence.

Finding enough energy to power the AI revolution “is one of the big unsolved questions,” he said in an interview. “We believe that nuclear — and maybe small modular reactors based near big data centres — is going to become an interesting area that’s also under-appreciated.”

Lancastle has held shares of uranium miner Cameco Corp since the first quarter of 2022. The stock is up about 80% since the start of that year.

A narrow environmental, social and governance investing mandate left stocks such as Cameco “under-loved” in the past, he said.

Other examples of nuclear-themed companies range from Constellation Energy, which is up more than 50% this year, BWX Technologies Inc, which has gained more than 20%, and NuScale Power Corp., whose shares have soared more than 150%. On the fixed-income side, investors can gain exposure to the nuclear power theme via companies including Orano SA, Urenco Ltd. and French utility Electricite de France SA.

The International Energy Agency estimated back in 2022 that global nuclear capacity would need to double by mid-century from 2020 levels to help the world meet net zero commitments. Meanwhile, how governments handle nuclear energy has had significant geopolitical ramifications. Germany famously wound down its nuclear energy program in the decade that followed the 2011 meltdown of Japan’s Fukushima plant. That decision has since drawn criticism, as Germany subsequently found itself deeply reliant on high-emitting fossil fuels supplied by Russia.

At the same time, the EU’s 2022 decision to include nuclear energy in its green taxonomy drew a barrage of criticism from environmental groups. Concerns include how to treat the radioactive waste generated by nuclear plants, which can take thousands of years to break down. Another worry is that nuclear technologies that fall into the wrong hands can be used to manufacture nuclear weapons.

Robeco’s Berkouwer says the firm’s process around selecting nuclear assets is full of checks and balances, and investments can’t go ahead if they expose Robeco to high-risk countries when it comes to nuclear safety. Also, any nuclear stocks tied to the defence industry end up on Robeco’s exclusion list, he said.

There are “several hula hoops” to get through before an investment goes ahead, he said.

Berkouwer says he sees potential investment opportunities in uranium miners, equipment suppliers, companies building the so-called small modular reactors, and electric utilities where nuclear is an important part of the energy mix. He also listed software providers, given many of the nuclear power plants need advanced software to operate properly.

But costs remain an issue, with nuclear plants often requiring billions of dollars in investments and generally taking longer to build than renewable energy facilities. That’s given nuclear “a bad reputation,” said Tal Lomnitzer, senior investment manager on the global sustainable equity team at Janus Henderson Investors.

Even so, costs “can be addressed by small modular reactors,” Lomnitzer said. “Public perception can hopefully improve with assurances from governments and others.”

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

COMMENTS 1

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.

Nuclear holds enormous promise.

They have been promising and promising and promising to solve energy challenges for decades.

End of comments.