China’s economy likely failed to reverse a monthslong slowdown rooted in depressed demand, especially after the disruption caused by extreme weather this summer.

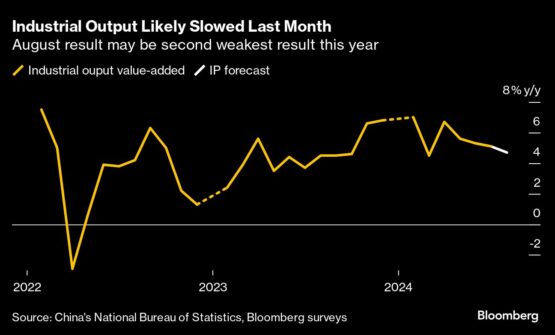

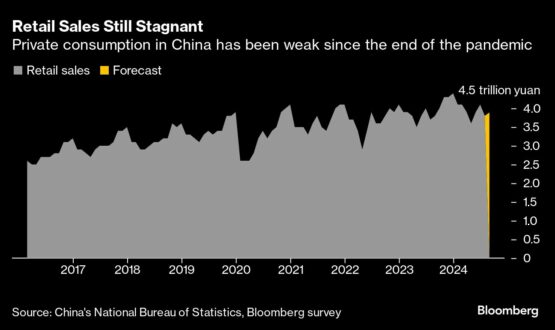

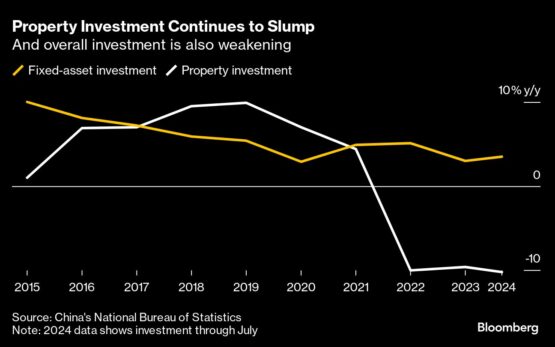

As pressure builds on policymakers to roll out more stimulus, data due Saturday will show growth in industrial production slipped in August for a fourth straight month, in what would be its longest deceleration in almost three years. A slower expansion in activity also extended to retail sales and investment, according to analysts surveyed by Bloomberg.

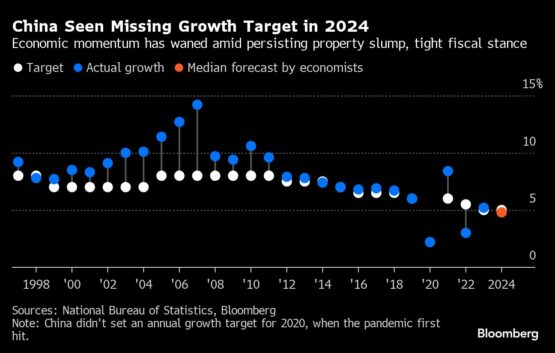

The widespread weakness would be a signal of how little traction the $17 trillion economy has generated in recovering from its worst stretch in five quarters. Heat waves — coupled with torrential rains that snarled travel and flooded farmland and mines — have added to setbacks for Beijing and its pursuit of growth around 5%, a goal most global banks now believe might be out of reach.

“The economy was under a double whammy of weather shocks and weak demand in August,” Citigroup Inc economists including Xiangrong Yu said in a report this week. “The ‘around 5%’ growth target could be at risk.”

Forecasts

| Consensus | Prior | |

| Industrial Production (YoY) | 4.7% | 5.1% |

| Fixed Assets Ex Rural (YTD YoY) | 3.5% | 3.6% |

| Retail Sales (YoY) | 2.5% | 2.7% |

The snapshot of activity will be the last reading before China releases its estimate of gross domestic product for the third quarter next month.

Evidence is already mounting that the world’s second-biggest economy is losing momentum, prompting analysts at banks including Citi to lower their projections. UBS Group AG cut its 2024 GDP growth forecast from 4.9% to 4.6% last month.

What Bloomberg Economics Says…

“China’s August activity data due Saturday will probably show the recovery lost more momentum. Weakness appears to have been widespread. Investment likely slowed further as bad weather disrupted construction projects and local governments struggled to deliver on spending plans. This may have damped industrial production.”

— Chang Shu, chief Asia economist, and David Qu, economist.

The figures for August will follow a meeting of China’s top lawmakers this week. Their gathering could endorse a plan to gradually raise the retirement age in a country where a worsening demographic crisis is weighing on its long-term economic potential.

Delaying retirement would slow the decline of China’s labour force while also presenting a more immediate threat to already-brittle sentiment among people who are uneasy over the prospect of working into their older years.

China’s core inflation — which strips out volatile items such as food and energy — cooled in August to the weakest in more than three years. As price pressures became more subdued, a former central bank governor made a rare appeal to focus on fighting deflation, a phenomenon that could hold back the economy if falling costs lead consumers to delay purchases and businesses to slash wages.

Here’s what to expect when the National Bureau of Statistics publishes the data:

Industrial Production:

Industrial production likely expanded 4.7% in August, according to the median forecast of economists polled by Bloomberg, a drop from 5.1% in July. Extreme weather events have disrupted construction projects and damped industrial production.

The country’s factory activity contracted for a fourth straight month in August, according to the official manufacturing purchasing managers’ index. The output sub-index slipped into contraction, signalling a decline in manufacturing.

In other signs of softening, the daily average output of crude steel decreased 7% in the first 20 days in August compared with the same period in the previous month. Thermal coal prices also fell from July, pointing to a slowdown in electricity output.

Consumption:

Retail sales rose 2.5% last month from a year ago, according to the survey, down from a 2.7% gain in July. The slowdown might be due to the statistical effect of a high base from 2023 and bad weather disrupting travel-related consumption.

While China recorded an increase in the number of summer travellers compared to 2023, year-on-year growth in August was probably slower as heat and floods disrupted travel and stifled spending.

Car sales, which account for a 10th of overall retail sales, also dropped an annual 1% in August, despite the government’s introduction of a cash-for-clunkers incentive for buyers who trade in old vehicles.

Investment:

Fixed-asset investment gained 3.5% in the first eight months from a year ago, according to forecasts, a further decline from 3.6% in the first seven months of the year.

The value of new-home sales from the 100 biggest real estate companies tumbled almost 27% year-on-year in August, accelerating from July’s 19.7% slump and indicating the waning impact of the latest rescue package unveiled by authorities in May.

Government-led investment is proving insufficient as local officials focus on easing back the debt burden. Provincial governments are selling new special bonds at the slowest pace since 2021.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

COMMENTS 1

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.

Demographics is destiny.

End of comments.