Oil steadied after its first weekly gain in a month as a drop in Libyan exports was offset by signs an economic slump in China is deepening.

Brent futures traded near $72 a barrel, while West Texas Intermediate climbed toward $69. Libyan exports have declined markedly as United Nations-led talks failed to break an impasse over control of the central bank, which has spilled over into its oil industry.

Chinese data out over the weekend showed industrial output in the longest losing streak since 2021 and investment falling more than expected, with the official economic growth goal of 5% for this year looking increasingly out of reach. The worsening situation in the No. 1 crude importer — along with an increase in global supply — have pushed Brent down by around 17% this quarter to near the lowest since late 2021.

The weakness in Chinese demand “will likely persist until we see China look to defend” its growth target, said Vivek Dhar, an analyst at Commonwealth Bank of Australia. “This may be only a month away, just like we saw last year,” he said, referring to Beijing boosting the budget deficit last October.

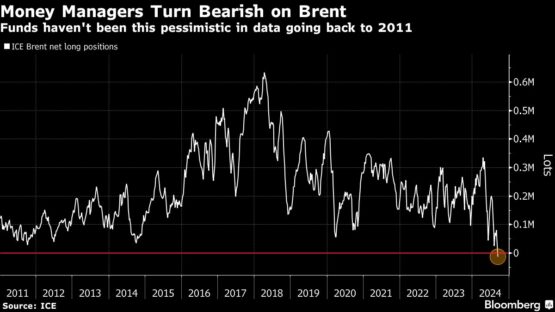

Hedge funds, meanwhile, have turned net bearish on Brent for the first time in data going back to 2011. Still, some of those short positions were starting to be unwound as prices recovered on Wednesday and Thursday last week.

The market is also tracking Typhoon Bebinca, which made landfall near Shanghai. It’s the strongest storm to hit China’s financial capital and major shipping hub since 1949. Financial markets in the country are closed on Monday and Tuesday for a national holiday.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

| Prices: |

|---|

|

© 2024 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

COMMENTS 0

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.