Taxpayers who take responsibility for funding their own pension and will not be a burden to the government after their working years qualify for generous tax relief.

In this, the first of two articles on tax-smart with retirement annuities (RA), we will look at the tax deductibility of your RA contributions, how this deduction can be seen as a kind of sponsorship from the government, and how crucial it is to your accumulation phase before retirement. In the second article, we will take a closer look at RAs and the effect of excess contributions before, at and beyond retirement.

These two articles aim to inform investors about the benefits of including RAs as the main vehicle for retirement savings and as a building block for wealth creation by illustrating the calculation criteria and the desired result it will create.

RA tax deductibility 101

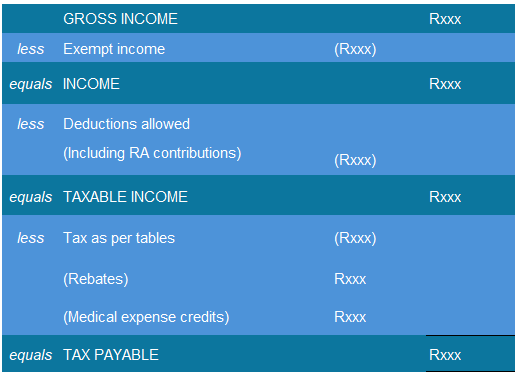

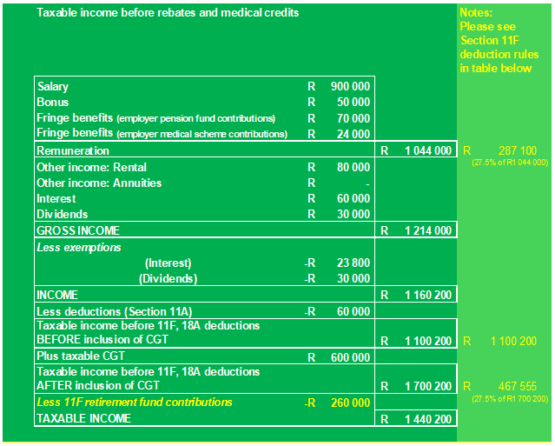

Below is an income tax template in one of its simplest forms:

Using this template as a basic framework, let us look at the effects that contributions to a pension/provident fund or RA will have on someone’s tax payable and accumulation towards their retirement. We will get into the rules and limitations later in the article; for now, we will grasp the concept by using the basic 27.5% limit of allowable deductions found in Section 11F(2) of the Income Tax Act.

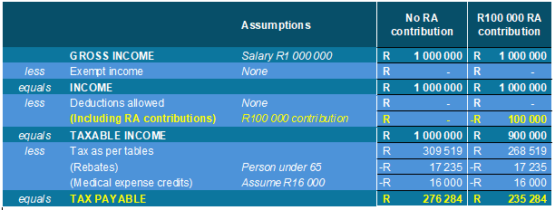

In the table below, we look at a taxpayer with an income of R1 million per year, comparing the tax payable when contributing R100 000 to a RA against the tax payable when no retirement fund contributions are made:

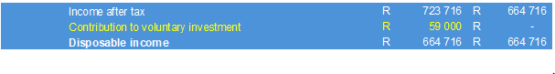

You will notice that the taxpayer who did not contribute to a RA increases their income after tax and their tax payable. However, they still need to save for retirement from their income after tax. To end up with the same disposable income, they can only contribute R59 000 to a voluntary (discretionary) investment for that purpose, as shown below:

In this scenario, the voluntary investment’s inception value is R59 000 compared with R100 000 for the RA. On top of this, the future growth of the RA attracts no tax on interest, dividends or capital gains, while the growth of the voluntary investment will be taxed.

Even though a RA has restrictions that ensure it will be used for retirement income and is limited under Regulation 28 of the Pension Funds Act (maximums for certain asset classes and offshore exposure apply), for the purpose of retirement provision, it is clear that the RA option offers value that is almost impossible to beat owing to a higher inception value and tax benefits on growth that will result in a higher maturity value.

More detailed example

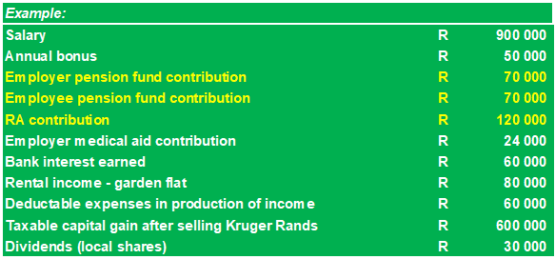

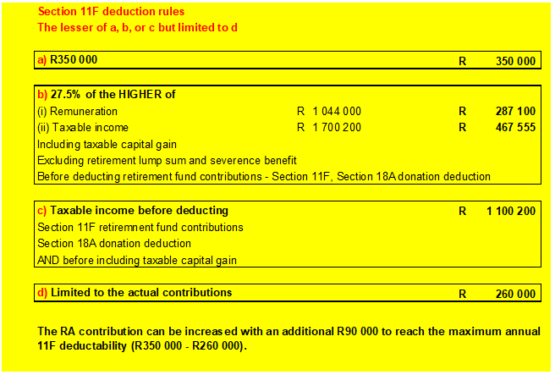

For the benefit of investors who would like to understand a little more about RA and pension/provident fund contribution deductibility as well as the contribution limitations, we look at the following example that shows where and how other factors, like interest, capital gains tax (CGT), or rental income, fit in:

We apply the information to a personal tax template to show the calculation of the maximum Section 11F deduction:

Below, you can see how the 11F deduction was calculated and whether additional contributions can be made to maximise the tax benefit for the applicable year of assessment:

We now have a better understanding of the tax benefit we receive when using RAs and how to maximise the tax benefit for an applicable year of assessment.

In the follow-up article, we will look at a practical example of excess contributions (disallowed contributions) to RAs and the tax benefits that they offer at the point of and after retirement.

COMMENTS 0

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.