China suspended the operations of PricewaterhouseCoopers LLP for six months and imposed a record penalty over lapses in its auditing of China Evergrande Group.

The accounting firm was fined 441 million yuan ($62 million) for its auditing work on Evergrande’s inflated financial reports from 2018 to 2020, statements by the Ministry of Finance and the China Securities Regulatory Commission showed Friday. The regulator also ordered the closure of PwC’s branch in Guangzhou.

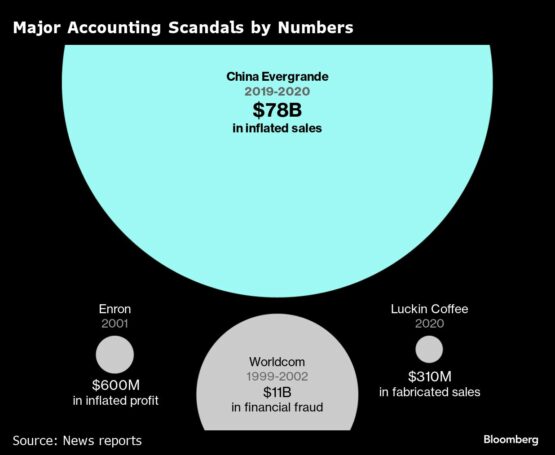

PwC has been under the spotlight after China launched one of the biggest investigations of financial fraud in history. Authorities have said developer Evergrande’s main onshore unit Hengda overstated its revenue by 564 billion yuan in the two years through 2020.

PwC “turned a blind eye” to Evergrande’s fraud, the securities regulator said in a separate statement.

“Such a severe penalty will have a major impact on the confidence of PwC’s remaining domestic clients,” said Pingyang Gao, an accounting and law professor at HKU Business School. “It is very likely that there will be a mass exodus. So it will likely spell doom for PwC’s business in China.”

PricewaterhouseCoopers Zhong Tian LLP, a Shanghai-registered firm that is part of PwC’s global network, was Hengda’s auditor during the period in question. PwC was Evergrande’s auditor for more than a decade until it resigned in January 2023, due to what the developer said were audit-related disagreements.

Read more: China Scrutinizes PwC Role in $78 Billion Evergrande Fraud Case

The CSRC found that 88% of PwC’s observation records on Evergrande’s property projects in 2019 and 2020 were untrue, leading to “severely unreliable” audit working papers.

Some residential projects that PwC considered to be finished at the time were still “vacant ground” when inspectors visited later, the regulator added. The accounting firm also deliberately avoided checking housing projects that Evergrande marked as “not to visit.”

‘Completely Unacceptable’

“The work performed by PwC Zhong Tian’s Hengda audit team fell well below our high expectations and was completely unacceptable,” PwC Global Chair Mohamed Kande said in a statement.

Daniel Li agreed to resign as the firm’s senior partner for China, but will continue to support the business in his role as chief accountant of the local unit, it said Friday. Hemione Hudson, global risk and regulatory leader, will take over on an interim basis and relocate to the region.

The fines include 325 million yuan by the CSRC, nearly the equivalent those doled out to more than 50 auditing firms in the past three years, the watchdog said. The Ministry of Finance imposed a 116 million yuan penalty.

Meanwhile, Hong Kong’s Accounting and Financial Reporting Council said its investigation into PwC’s audits of Evergrande in the city remains in progress.

Among the Big Four global accounting firms, PwC was one of the most commonly used by Chinese real estate companies listed in Hong Kong, according to data compiled by Bloomberg. It audited the books of some of the nation’s largest developers, including Country Garden Holdings Co. and Sunac China Holdings Ltd., before they also defaulted on their debt.

Read more: PwC Resigns as Country Garden’s Auditor Amid China Probes

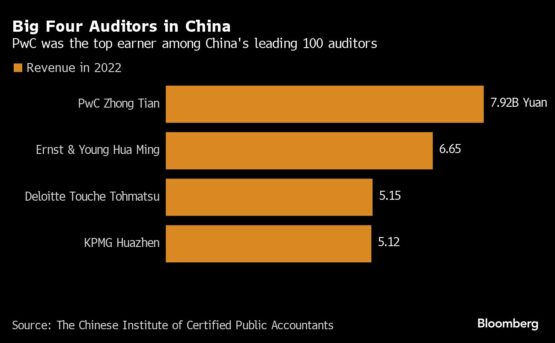

PwC’s onshore arm, with 291 partners and more than 1,700 certified accountants, reported revenue of 7.9 billion yuan in 2022, making it the top earner among more than 9,000 local rivals, according to official data. Still, that’s a fraction of its global revenue of $50.3 billion during the year.

Since March, more than 30 publicly listed companies based in mainland China have dropped PwC as their auditor, according to stock-exchange filings. State-owned giants Bank of China Ltd., China Life Insurance Co., China Telecom Corp. and PetroChina Co. were among them. The Chinese companies that recently dropped PwC paid more than 800 million yuan in total fees to their auditors last year, according to calculations by Bloomberg News based on disclosures in the companies’ annual reports.

The firm was also cutting at least 100 staff across its China operations in July, Bloomberg reported. More than half of one team was laid off, according to people familiar with the matter. The threat of regulatory penalties and the loss of Chinese corporate clients had also prompted some employees to seek opportunities elsewhere.

During China’s housing boom, most property developers raked in cash by selling partially built homes and promising to deliver them in a few years. Buyers put down deposits and took out mortgages. Their money was supposed to be put in escrow accounts and released to the developers when construction was completed.

While many Chinese developers have stated in their annual reports similar revenue-recognition policies, Evergrande may have pushed the limits further.

Prior to 2021, Evergrande recorded revenue from contracted sales of many projects before completing and delivering the homes to buyers. That enabled the developer to report lower liabilities and leverage ratios, which facilitated its sales of domestic and international bonds.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

COMMENTS 0

You must be signed in to comment.

SIGN IN SUBSCRIBE

or create a free account.

Free users can leave 4 comments per month.

Subscribers can leave unlimited comments via our website and app.